Why to invest in AI billing software

Are you tired of dealing with manual, tedious, and time-consuming billing processes? Or even worse, billing errors? You’re not alone. Traditional bill payment methods are not just slow—they're expensive, often hitting you with high transaction fees just to pay your vendors.

Think about all the time and resources wasted chasing down vendor information, doing manual data entry, and waiting on approvals from department heads. It’s a never-ending cycle that drains your energy and productivity.

On top of that, juggling multiple finance platforms to get a clear view of your cash flow is frustrating. It’s hard to make important decisions when your data is scattered and disjointed.

In this blog, we’ll dive into how AI billing software can streamline your accounts payable (AP), save you time, and help you scale with ease.

The power of real-time syncing

Imagine having your expenses automatically updated on a dashboard. No more waiting for end-of-month reports, dealing with outdated information, or getting frustrated about error-prone workflows.

With real-time reporting and analytics, you get an immediate view of your bills, payment history, and spending trends. This means you can see where your money is going at any moment. Need to check the status of a payment? Review your payment history? Spot spending patterns? It’s all right there, instantly.

This real-time insight helps you make smart decisions quickly. You can catch potential issues early, optimize your cash flow, and make confident financial choices. Plus, everything stays consistent across your financial tools, so you’re always working with the most accurate data.

How to streamline your accounts payable process with automation

Streamlining your AP process with automation can save you time, reduce errors, and improve efficiency. Here’s how you can make it happen:

- Automate Data Entry: Manual data entry is time-consuming and prone to errors. With automation, you can automatically capture and input invoice details directly into your system.

- Set Up Automatic Approvals: Waiting on approvals can slow down your AP process. By setting up automatic approval workflows, you can ensure that invoices move quickly through the necessary channels. Define approval criteria and thresholds to streamline the process, ensuring only exceptions require manual review.

- Schedule Recurring Payments: For regular expenses like rent, utilities, or subscriptions, set up recurring payments. This ensures you never miss a payment deadline and can better manage your cash flow. Automation takes care of these repetitive tasks, giving you peace of mind.

- Utilize Real-Time Tracking: Automation tools offer real-time tracking of invoice statuses. You can see where each invoice is in the approval process, when it’s scheduled for payment, and when it’s been paid. This visibility helps you stay on top of your payables and avoid late fees and helps with financial forecasting.

- Integrate with Your Financial Systems: Ensure your automation tools seamlessly integrate with your existing financial systems. This integration eliminates the need for duplicate data entry and ensures your financial data is always up-to-date and accurate.

- Implement Alerts and Notifications: Set up alerts and notifications for important events, such as upcoming due dates, approval needs, or payment confirmations. This keeps everyone informed and ensures nothing falls through the cracks.

- Enhance Vendor Communication: Automation can also improve communication with vendors by providing them with self-service portals to check payment status, submit invoices, and update their information. This reduces the back-and-forth emails and phone calls, making the process smoother for both parties.

- Utilize AI Technology: Leverage artificial intelligence to enhance every aspect of your AP process. AI algorithms can predict payment patterns, detect anomalies, and provide data analytics to improve decision-making. By using AI, you can further reduce errors, optimize cash flow, and ensure data integrity and compliance with financial regulations.

Benefits of streamlined bill payments

There are many types of billing systems to choose from but it’s important it achieves specific criterias before investing in the billing provider. Here are the benefits to keep an eye out for:

Saves you time and money: Reduces the risk of human error and frees up your team to focus on more strategic tasks.

Increases your workflow efficiency: Automation speeds up invoice processing, approval workflows, and payment scheduling, ensuring payments are made on time.This improves overall operational efficiency by redirecting efforts to value-added tasks.

Improves vendor relations: Timely and accurate payments strengthen your customer experience with suppliers. Automated systems ensure prompt payments, enhancing trust and transparency through clear communication and self-service portals.

Zeni’s Billing Software deep dive

.avif)

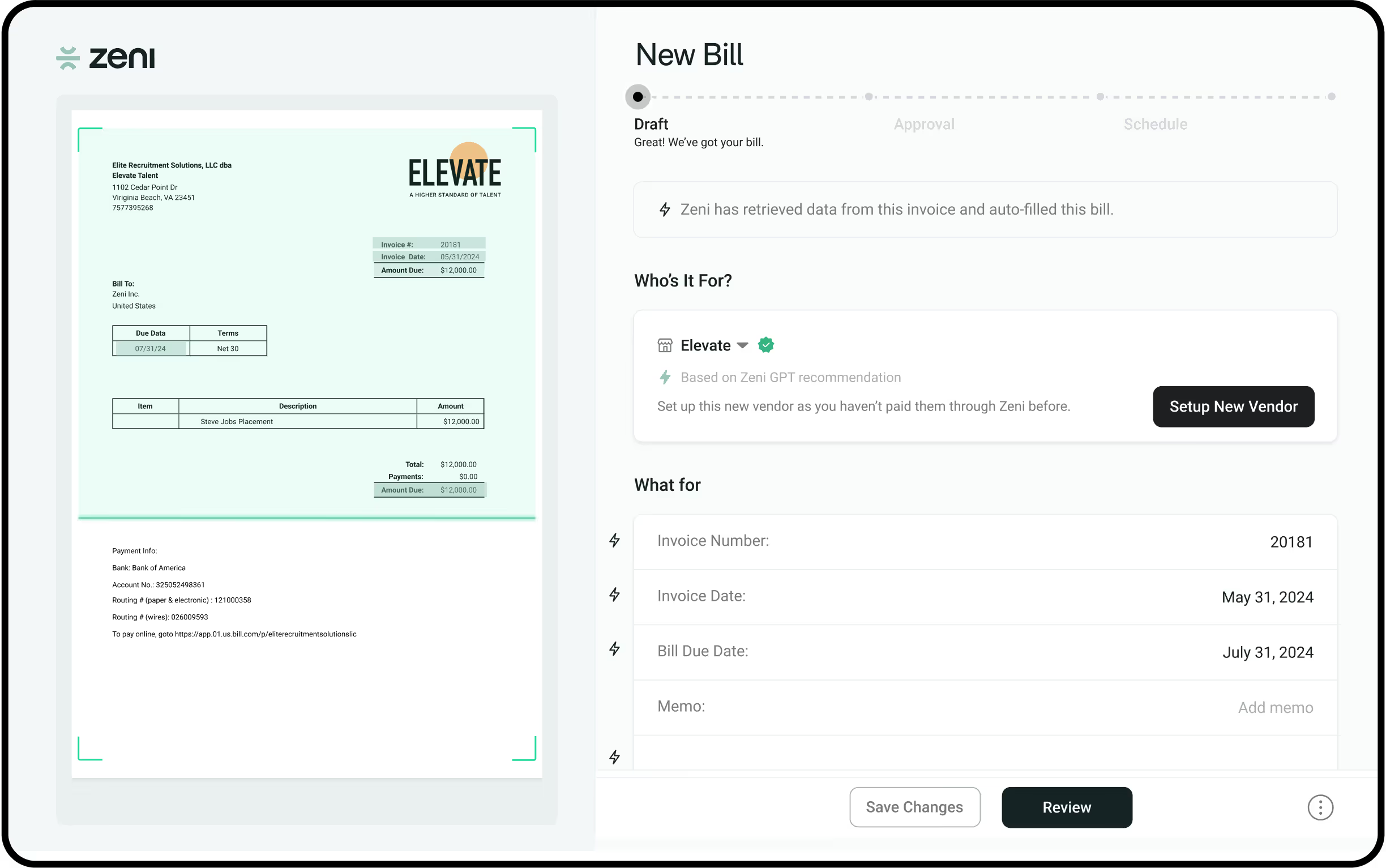

Introducing Zeni Bill Pay – the fastest way to pay vendors, both domestically and internationally, and automate your accounts payable process from start to finish directly from the Zeni Dashboard. And it’s free!

Whether you’re new to Zeni or an existing customer, it’s the easiest, most cost-effective way to pay vendors and contractors with minimal management of the process on your end – so you can get back to running your business.

The road to automation is simple. Here’s how it works (the quick version):

- Upload a Bill – Zeni’s AI automatically populates all the billing information. You save time and reduce the risk of error.

- Review and Submit – We’ve streamlined the review step. Quickly review the information and submit the bill for approval.

- Seamlessly Approve and Pay – Your bill goes through an efficient approval payment process. Once approved, the payment will be made on the due date — helping you control cash flow.

That’s it! Of course, you’ll need to perform one or two tasks to set up a system that benefits your startup’s needs, but once you’re up and running, you’ll have a well-oiled AP machine

So, let’s get into the whole process and your role.

Process Overview

Other bill pay solutions require manual data entry from start to finish.

From receiving an invoice to tracking down vendor payment details to paying bills by bank portal (and yes, even checks!) and then making sure your document it all in your general ledger properly…. we’re sweating just thinking about it.

This manual process is the core part of what makes invoice management an arduous task.

Keep reading to see what a non-manual process looks like with Zeni Bill Pay.

Bill Pay Dashboard

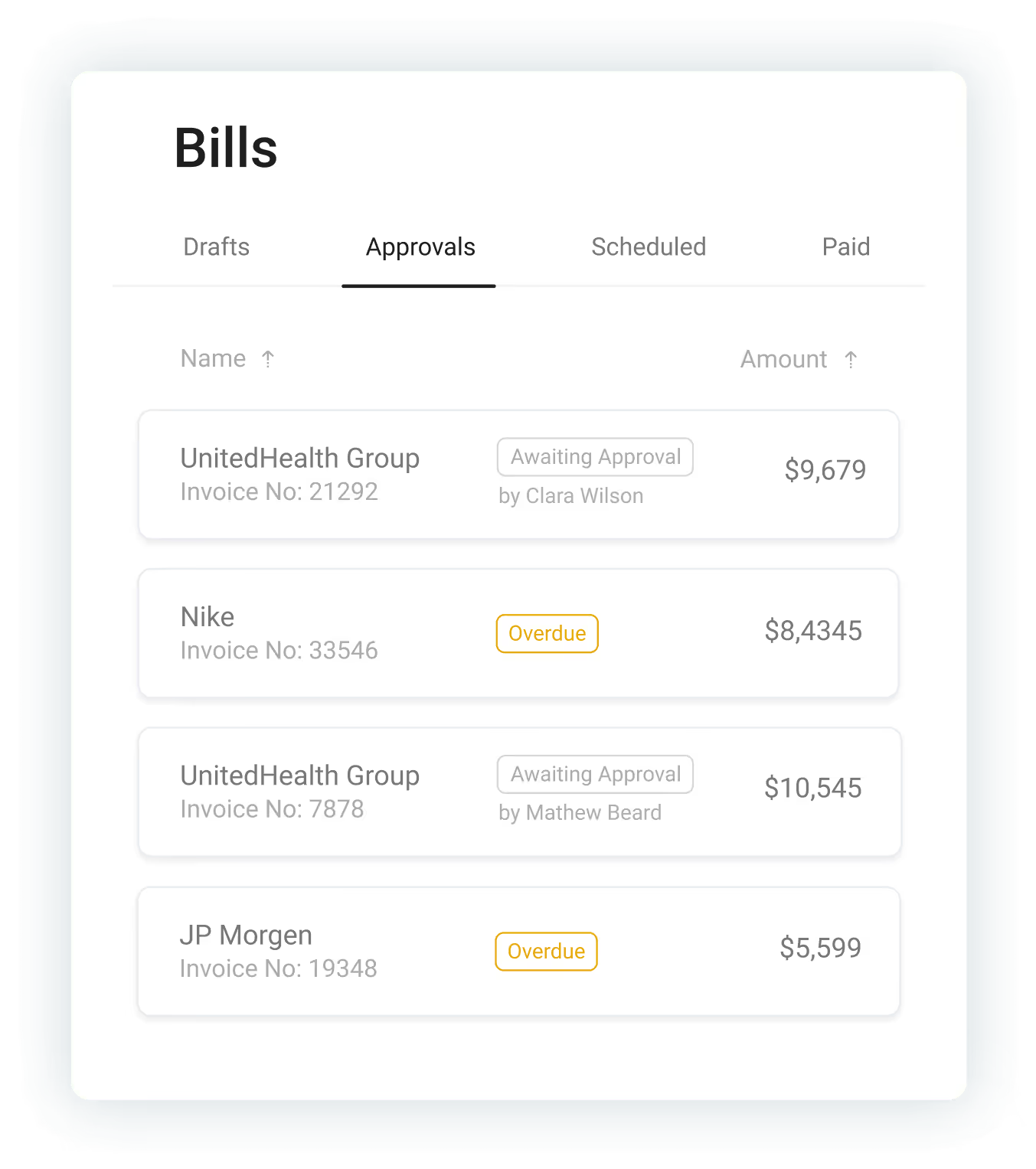

.png)

If you’re unfamiliar with our Dashboard, we house all your financial data in one spot. Each card on the Dashboard is interactive and expandable to show detailed pieces of financial information.

The Bill Pay card represents AP-related tasks and statuses in the same way by showing you all your bills and what lifecycle they’re currently in:

Draft stage – Bills currently open for edits

Approval stage – Bills awaiting approval

Scheduled stage – Bills that have been approved and scheduled for payment.

Paid stage – Bills considered paid with funds are on their way to the vendor’s bank account.

This is the simplest way to always know where your money is and ensure you are paying invoices on time.

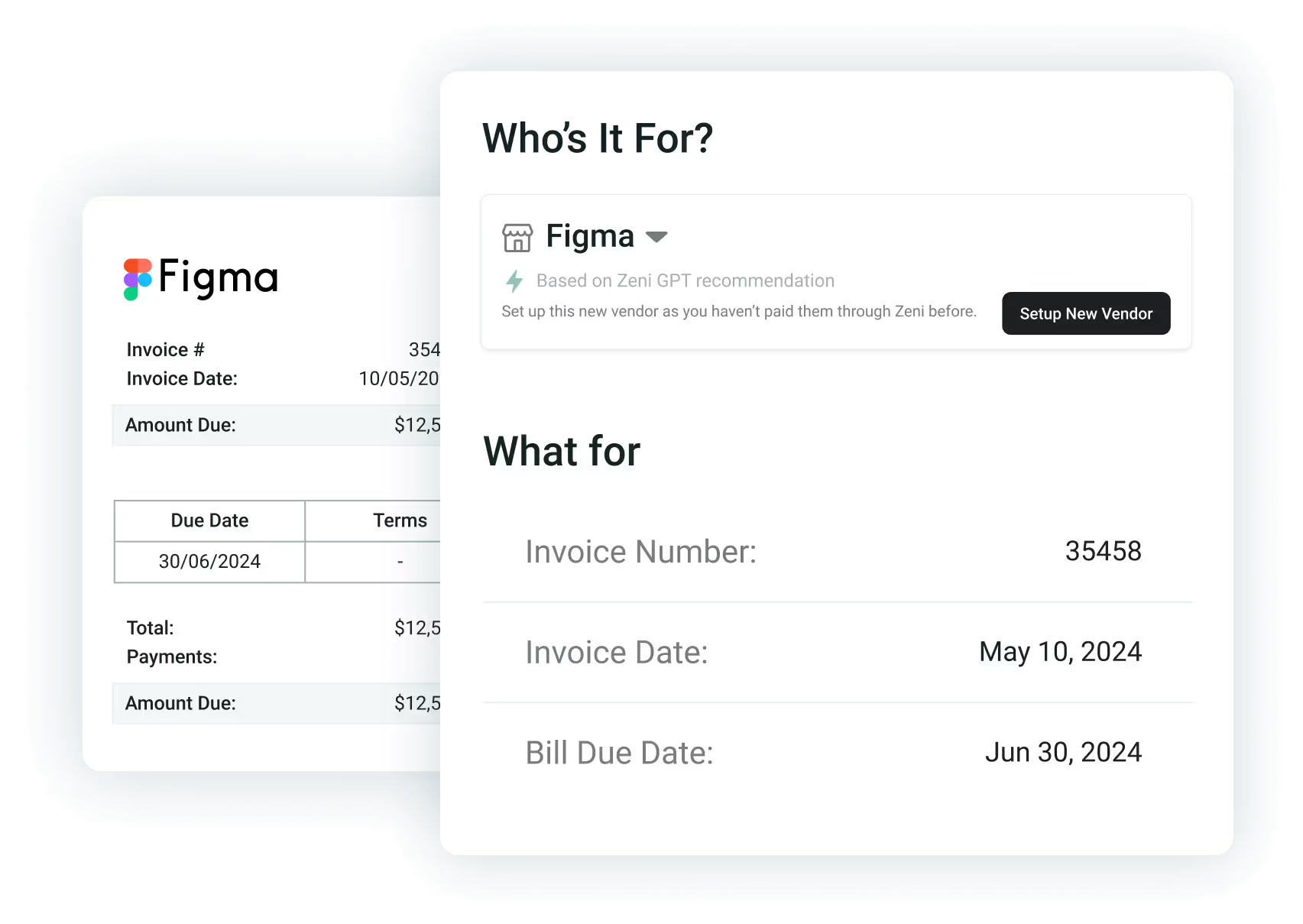

Creating A Bill

.avif)

Once you receive an invoice, simply upload the bill with Zeni’s uploader tool. AI then quickly pulls the data and transfers it to create a new bill in seconds. If you’re using our add-on Accounts Payable Services, use your personalized Zeni email and send the invoice to that account – Zeni takes care of the rest.

Our software automatically pulls the vendor’s name and assigns the bill to that vendor. Then pick your payment method. Zeni supports ACH same day, domestic and international wire transfers.

If you are receiving a bill from an international vendor

International vendors must submit requests in USD. Coming soon, Zeni will add payouts to counterparties in their local currency.

You can choose to review the bill before sending it for approval or assign to someone else on your team. Remember that you can also set your approval flows beforehand based on dollar amounts so that this process stays automated. More on this below.

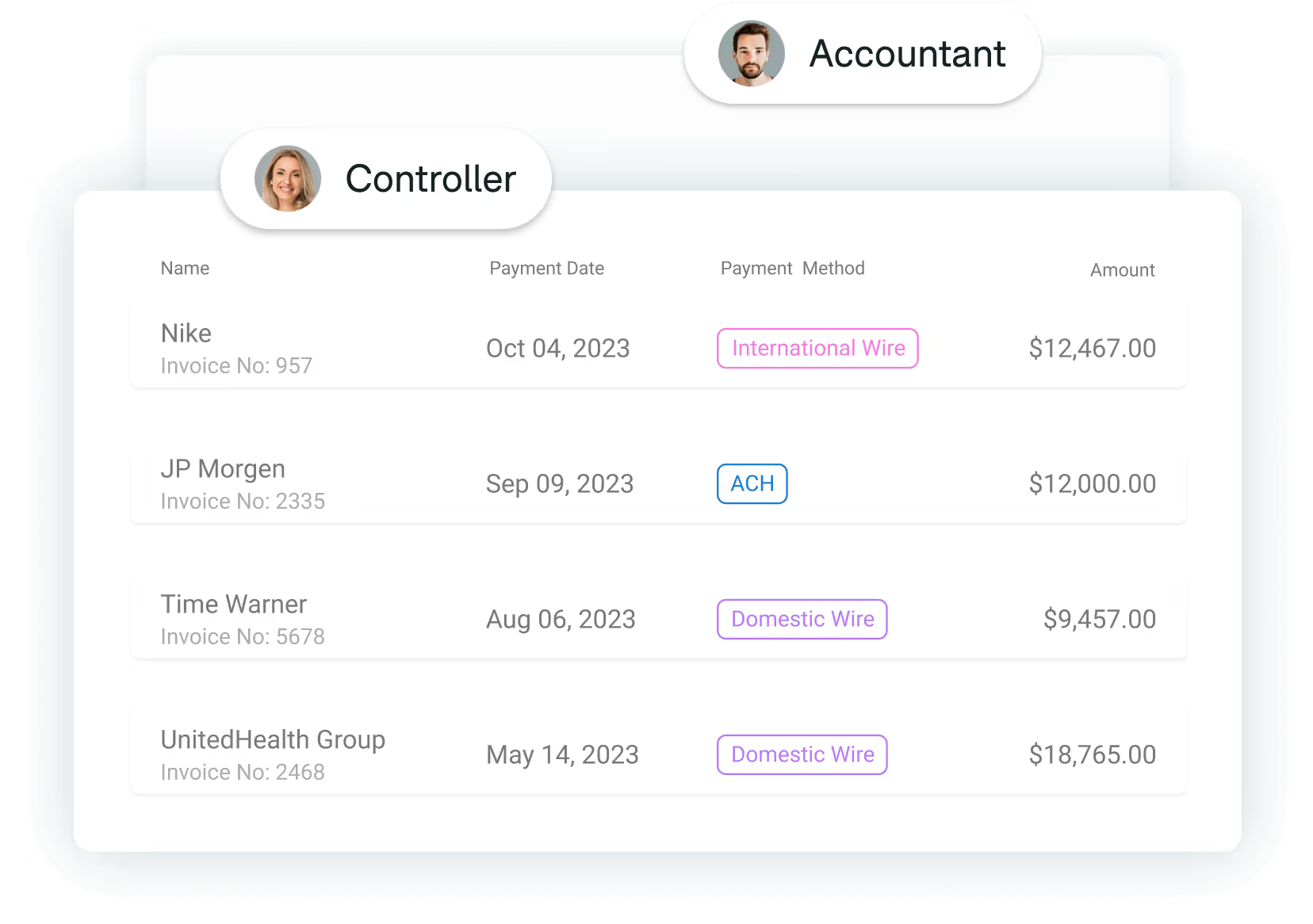

Approving A Bill

.avif)

All Zeni Bill Pay users can access the Dashboard, but only some roles receive bill approval notifications. You can set specific permissions to approval roles like amount limits. If a specific person can approve bills up to $30k, they’ll receive a notification on the Zeni Bill Pay card for bills at and below the limit.

If the bill doesn’t require edits, click approval, and you’re all set. Employees in these roles also have access to editing even in the approval stage. You can edit vendor details, payment amounts, and bank information here.

Our favorite reasons to automate AP with Zeni Bill Pay

- Save money – Zeni Bill Pay is 100% free. Yes, you read that correctly. Anyone can use Bill Pay at no additional cost to an existing Zeni subscription. We don’t even charge ACH fees.

- Eliminate the chance of error – Instead of manually inputting your vendor information and invoice details each time, simply upload an invoice to Zeni Bill Pay. Our AI auto-fills all the information in seconds and remembers your vendor information for future payments and classifications.

- Increase efficiency – There’s no manual entry, which reduces the time and effort required to process and pay bills. You can also customize internal approval rules based on bill amounts and automate flows to make payments to vendors hassle-free. Zeni AI processes the invoice in real-time and updates your books daily in the process instead of at month-end.

- See everything in one place – Bill Pay lives directly in your Zeni Dashboard. When you open the dashboard, you can easily see the status of all of your payments (and all your other financial information, including reimbursements) on one platform.

- Increased visibility into finances – AI keeps all of your data up to date. With real-time reporting and analytics, you can have greater visibility into the status of your bills, payment history, and overall financial health.

- Pay domestically and internationally - Manage your vendor payments, both domestic and international, from a single platform. You have four options when it comes to payment pricing:

1. ACH: 3-4 business days, $0

2. ACH Same Day: $0

3. Domestic Wire: $10

4. International Wire: 4-5 business days, $20

Zeni-managed Accounts Payable Services

Zeni Bill Pay is fully self-service, but sometimes you need an extra hand. As a startup, we know how cumbersome it can be to manage different aspects of your business on top of financials.

That's why we recommend pairing Zeni Bill Pay with our AP management services to streamline your AP process. It's free to add if you're processing fewer than 10 bills per month.

By adding on AP Services, our personal Zeni team manages three important aspects of the bill pay process – vendor management, email communications, and bill management.

To learn more about our payment plans for AP Services, schedule a demo.

Bill Management

Your dedicated Zeni team takes care of uploading invoices to Bill Pay, scheduling, and reviewing them on your behalf. We also establish your rules and approval flows and manage them accordingly, including setting up amortization and categories on each line for all bill line items in your ledger.

If any errors pop up through the billing cycle, Zeni is on deck daily to tackle these the moment they arise.

Of course, you can access all of the information through your Zeni dashboard to see how the workflow is going at any given time. Viewing all of your bills and payment statuses looks lives all in one place and is easily accessible by anyone on your team with permissions.

Vendor Management & Email Support

Consistent contact with vendors is necessary, but founders don’t always have time, especially when you have to contact vendors multiple times to get the information you need. With AP Services, we’ll communicate with vendors and contractors for you to collect anything from contracts and payment details to tax info and forms.

Say hello to one less email chain in your inbox!

Using AI for invoice processing

Artificial intelligence is changing the game for everything. Within the FinOps space, AI systems help businesses ensure their data is more accurate, and less labor-intensive.

By harnessing AI-powered technology to automatically match invoices with purchase orders and delivery receipts, you can reduce manual effort and quickly identify discrepancies.

With ZeniGPT, which leverages advanced AI and machine learning, vendor transactionsare categorized, deduplicated, and merged seamlessly, streamlining your workflow and enhancing accuracy.

.avif)

Scale with ease: Billing solutions for growing businesses

Paying bills – we all have to do it. For small businesses looking to grow, transaction numbers climb as you expand, add team members, and accrue additional expenses. To keep your head, and finances, above water, you need an efficient invoice management and bill pay system.

Leveraging AP automation software gives you time back and streamlines the process without forgoing accuracy. You don’t need to shell out a hefty amount of cash to do so, either. Instead of relying on complex and costly software, come see what Zeni Bill Pay can do for you.

As a startup, we have a unique perspective and deep understanding of what a startup needs to run efficiently. We’d love to show you exactly how our bill pay services work and get to know you better. Take advantage of the ‘zen’ in Zeni – let us handle the responsibilities and relieve the stress of managing bill pay and accounts payable. Our #1 priority is ensuring customer satisfaction when using any of our products or services.

If you're ready to get started book a demo or 1-1 call with us here and we'll get you set up automating your bill pay in no time.

.webp)